selling a car in washington state sales tax

In addition to use tax youll be responsible for. Online Report of sale without logging in or creating an account Log in or join to report the sale from your License eXpress account or At a vehicle licensing location Fill out the Vehicle Report of Sale English Español Русский and more form.

2022 Washington State Ev Trends Electric Car Research

Its in your best interest to file as soon as possible.

. Alternative Fuel Vehicles and. The state of washington charges 1325 to report the sale of a vehicle. But unlike a sales tax which is based on purchase price a use tax is based on a vehicles fair market value.

According to the sales tax handbook a 65 percent sales tax rate is collected by washington state. In addition to the general use tax rate vehicles are charged an additional 03 motor vehicle salesuse tax. When we think of sales taxes we generally think about everyday transactions in which businesses sell goods ie inventory to consumers in.

Use tax is calculated at the same rate as the sales tax at the purchasers address. Selling A Car In Washington State Sales Tax. This number is a sum of the base state sales tax of 65 plus a 03 motor vehicle saleslease tax However this.

Sales that are exempt from the retail sales tax are also exempt from the motor vehicle saleslease t See more. The state sales tax on a car purchase in Washington is 68. The fee is 1325 you can file your report.

Sales tax can be assessed on the sale or acquisition of a business and parties to a transaction should carefully examine states casual sale. Have you sold traded or given away a car truck motorcycle or another vehicle. Motor vehicle dealers and motor vehicle leasing companies must collect the additional sales tax of three-tenths of one percent 03 of the selling price on every retail sale rental or lease of a motor vehicle in this state.

Selling A Car In Washington State Sales Tax. Washington state vehicle sales tax on car purchases. Find out what you need to do.

The state of washington charges 1325 to report the sale of a vehicle. The state average for. Buying a new car insurance.

This percentage applies if you make more than 434550 for single filers or 488850 for those filing jointly. Cars purchased in the state of Washington are subject to a 68 state sales tax but county and local rates can add up to an additional 35 in sales tax. There is a fee of 1325 to report you no longer have your vehicle.

Selling a vehicle Report the sale of a vehicle. Selling A Car In Washington State Sales Tax.

Tax Incentive Programs Washington Department Of Revenue

Washington State Vehicle Title Transfer Guide Sell My Car Now

Sticker Shock For Washington S Hybrid And Electric Car Owners 75 Fee In Their New Car Tab Bills The Seattle Times

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Washington State Vehicle Title Transfer Guide Sell My Car Now

Sales Tax Definition How It Works How To Calculate It Bankrate

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Washington Sales Use Tax Guide Avalara

All About Bills Of Sale In Ohio Forms Templates Facts Etc

Cheapest States To Buy A Car Forbes Advisor

How Do State And Local Sales Taxes Work Tax Policy Center

Nft Purchases Are Now Being Subject To Sales Taxes

What New Car Fees Should You Pay Edmunds

Sales Tax Laws By State Ultimate Guide For Business Owners

A State By State Analysis Of Service Taxability

How To Gift A Car A Step By Step Guide To Making This Big Purchase

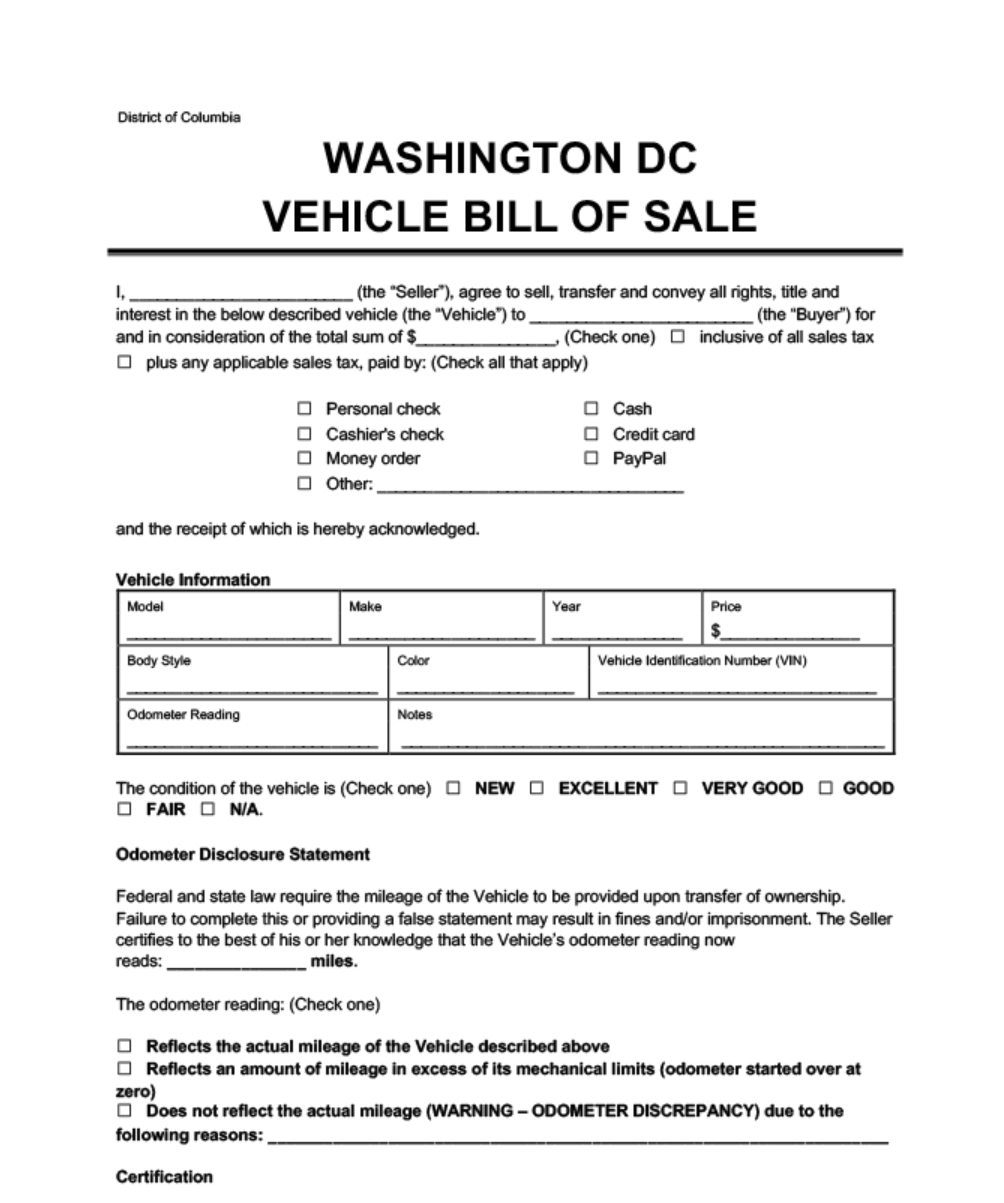

Get Washington D C Auto Bill Of Sale Form Usedautobillofsale Com

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)